top of page

The KingfisherAir Deccan Merger- Why a Perfect Deal Failed Final

The Air Deccan Revolution In August 2003, Captain G. R. Gopinath launched Air Deccan with a promise that sounded almost absurd at the time: “Now every Indian can fly.” This was not a slogan designed by an advertising agency. It was a business philosophy. Air Deccan introduced the true low-cost carrier (LCC) model in India. Tickets were sold for as little as ₹1, and every operational decision was designed to minimise costs—no free meals. No frills. High aircraft utilisatio

Why Is Bitcoin So Expensive? - An Economic Perspective on Scarcity And Valuation Formation

Bitcoin’s high price often causes confusion and scepticism, especially when compared to traditional assets like gold or fiat money (government-issued money). To understand why Bitcoin has such high value, one must examine how scarcity operates, how markets determine prices and how Bitcoin fundamentally differs from other scarce assets. If viewed through an economic lens, Bitcoin may be seen as a type of monetary good whose prices emerge from rational behaviour and, at times,

Hostile Takeovers: The Corporate Chess Game of Chaos

In the boardroom, a hostile takeover acts as an unfriendly move. While mergers and acquisitions are celebrated with champagne, leading to fruitful partnerships among companies, a hostile takeover starts with a rejected offer and ends with a siege. So, your question must be: what are hostile takeovers, and why are they subject to such scrutiny? In the world of corporate finance, a hostile takeover is like the relative who decides that they own the house. It occurs when the

Vijay Mallya: The Personality That Built and Broke Kingfisher Airlines

Vijay Mallya’s public image today is inseparable from corporate scandal and financial collapse. Yet reducing him to a cautionary headline misses a deeper and more instructive story. This article is neither a defence nor a hit piece. It is an attempt to understand how Vijay Mallya’s personality—his instincts, beliefs, and excesses—first created enormous value and later destroyed it. More importantly, it explores how that personality shaped one of India’s most ambitious and

ICICI Prudential AMC IPO: Evaluating a Market Leader in India’s Mutual Fund Boom.

Company Overview: A joint venture between one of India's largest banks and a British multinational insurance and asset management company. Founded in 1993, ICICI Prudential is an India-focused financial services group, with ICICI Bank holding a 51% stake and Prudential Plc holding 49%. While ICICI Bank offers in-depth knowledge of Indian investment practices, Prudential Plc offers international, best-in-class asset management expertise. The joint venture helped access distrib

From Compliance to Competitiveness: The Green Economy’s Effect on Corporate India and ESG Reporting

Green Economy and ESG Accounting: Growing Sustainability A green economy, or sustainable economy, is a model that fosters growth while protecting natural resources and ecosystems for future generations. ESG (Environmental, Social, and Governance) reporting details how companies disclose sustainability practices. Understanding the Green Economy A green economy advances sustainability by balancing environmental protection, social well-being, and economic growth. Unlike traditio

Wakefit Innovations: From Mattress Startup to Market-Shaping IPO

Company Overview: Imagine starting a venture in the small corner of Bengaluru, selling just one thing: mattresses. A few years later, the same company is launching an IPO (Initial Public Offering) to become a prominent player in the home market. That company is known as Wakefit Innovations Limited – expanding from a “sleep specialist” to a full-blown “home solutions giant”. Founded in 2016, Ankit Garg and Chaitanya Ramalingegowda identified a fragmented mattress marke

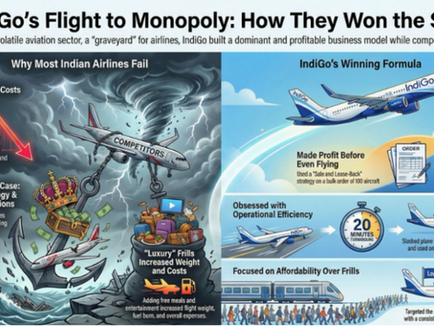

How Indigo Survived in the Graveyard of Indian Civil Aviation?

Sir Richard Branson, co-founder of the Virgin Group, once said, "If you want to be a millionaire, start with a billion dollars and launch a new airline." These lines perfectly illustrate that India is often referred to as the "Cremation Ground" or the "Graveyard of Airlines." Between 1991 and 2006, nearly 14 airlines shut down, including Air Deccan (acquired by Kingfisher), Air Sahara (sold to Jet Airways), Paramount (closed), and Indian Airlines (merged into Air India), am

The Tier-2 Titan: How Meesho Conquered the Market Others Couldn’t Reach

Company Overview: In the expanding competitive arena of Indian e-commerce, where industry giants such as Amazon and Flipkart have dominated because of their convenience and reach, Meesho emerged as a new alternative in 2015. Founded by Vidit Aatrey and Sanjeev Kumar, Meesho acted as a peer-to-peer social commerce platform for local individuals, especially women entrepreneurs to resell their products. This was previously done through WhatsApp and other social media channels l

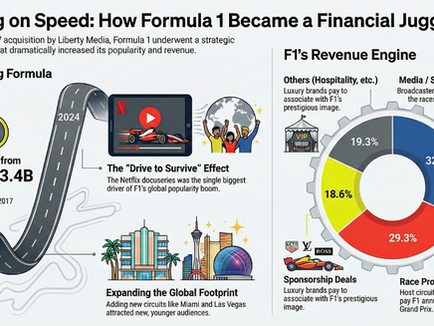

Banking on Speed: The Money Machine Powering the World’s Most Expensive Sport.

When we think of Formula One, we usually think of the intense rivalries, the fast cars, the celebrity-studded paddocks. Something much bigger is happening in the shadows. While Lando is fighting Verstappen, turning F1 from the least-engaged major sport in 2017 into a sport with movies being made about it in 2025. The money told the same story: revenue for F1 grew from $1.8 billion in 2017 to $3.4 billion in 2024, while operating income reached $492 million. The fate of Formul

Advanced Derivatives: Swaps & Option Exercise Styles

A swap claim refers to the contractual right to receive net payments under a swap agreement. It is more of a legal concept that describes the enforceable obligation owed by a counterparty during the life of the swap or upon default or early termination. Interest Rate Swap Example: A company with a $100 million floating-rate loan (SOFR + 1.5%) wants stable interest costs, so it enters into a swap in which it pays 4% fixed and receives SOFR. If SOFR for a payment period is 3.8%

Foundations of Derivatives: Concepts, Categories & Intuitive Examples

A derivative is a financial contract whose value depends on one or more underlying assets. Traders use derivatives to hedge risk, speculate on price movements, or gain leveraged exposure. These instruments allow traders to reach specific market positions at a lower cost and with greater flexibility than using the underlying assets directly. Derivatives fall into two main categories: forward claims and contingent claims. Forward claims obligate both parties to follow the agree

Hedging Made Simple: How Smart Investors Stay Safe

Risk is often viewed as a simple dilemma – win or lose. However, professional managers know risk as a complex structure. Suppose you buy car insurance. You don’t want your car to crash, and if it crashes, the insurance will save you from financial ruin. Similarly, when you invest, there is a risk that the investment may result in a loss. It may be due to price uncertainties, global tariffs, economic policies, and other factors. That’s where hedging comes in. Hedging is not a

From Chalkboard to Capital Markets: The PhysicsWallah Journey and What Its IPO means for Indian EdTech

Humble Origins, Vision & Functioning PhysicsWallah (PW) was founded by Alakh Pandey, a humble start from a YouTube channel, as a physics teacher and science enthusiast from Allahabad, in 2014. His approachable teaching style, emphasis on conceptual understanding, and affordable content have quickly earned him massive student loyalty, as evident from the ~14 million subscribers on his main YouTube channel. In 2020, PW was formally incorporated as PhysicsWallah Pvt. Ltd. and la

Groww’s ₹6,600 Crore IPO: Can India’s Digital Investing Giant Justify Its Premium?

Billionbrains Garage Ventures Ltd, the parent company of investment platform Groww, has set the stage for one of the most anticipated listings of the year, raising approximately ₹6,632.30 crore, including both the fresh issue and the offer for sale. Founded in 2017 by former Flipkart executives Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh, Groww is a Direct-to-Customer (D2C) digital investment platform. Revenue is primarily generated from brokerage income and dist

Aviation Diaries.

#100daychallenge Let’s talk about some major trends in the Indian Aviation sector. The number of non-scheduled airlines is on the rise, 119 as of 31 December 2024, compared to 103 in 2023. Scheduled airlines are big airlines like Indigo that operate flights on a regular timetable. For example, a flight will fly from Pune to Bangalore at 2:30 a.m. every day. On the other hand, in a non-scheduled airline , flights are arranged as needed, for example: chartered planes or an airl

PhonePe IPO: India’s Digital Artery Hits Wall Street

While the name may still seem outlandish to global investors, even whimsical to Indians, it has almost become synonymous with money...

Aviation Diaries.

#100daychallenge India accounts for 17.8% of the global population, but only accounts for 4.2% of passengers. Disposable incomes and the population are also on the rise. These factors underpin a clear opportunity for growth in India's aviation sector. Major companies have noticed this and started building capacity to address future demand. Over the last decade, the commercial aircraft fleet has grown at a CAGR of 7.6% (3x the global average). Currently the aircraft fleet cons

The Strange World of Negative Interest Rates

When the word interest rate comes to mind, we usually think of paying an extra amount on a loan or earning returns on savings . Now...

"Get rich quick" the truth about Ponzi schemes

People yearn for power and influence—and often, all it takes is a piece of bond paper, also known as ‘money’. You've probably heard the...

bottom of page