How Indigo Survived in the Graveyard of Indian Civil Aviation?

- themorrigannews

- Dec 8, 2025

- 5 min read

Sir Richard Branson, co-founder of the Virgin Group, once said, "If you want to be a millionaire, start with a billion dollars and launch a new airline."

These lines perfectly illustrate that India is often referred to as the "Cremation Ground" or the "Graveyard of Airlines."

Between 1991 and 2006, nearly 14 airlines shut down, including Air Deccan (acquired by Kingfisher), Air Sahara (sold to Jet Airways), Paramount (closed), and Indian Airlines (merged into Air India), among others. Despite all the above examples, Indigo not only survived but also became the most profitable airline in Indian History.

This story would be incomplete without discussing the architects of Indigo —the people often compared to “Jobs–Wozniak” in aviation: Rahul Bhatia and Rakesh Gangwal. What's so fascinating is that Indigo remained profitable for a decade from 2008 to 2018 (marketing360.in). Currently commanding 63% domestic market share (NDTV). First to fly 10 crore passengers within one year. In 2006, when the industry fleet in India consisted of 305 planes, Indigo alone had around 430 jets. Indigo operates over 2,000 daily flights across 400 routes, including 122 domestic and 34 international destinations, with plans to expand to 440 global destinations.

Now, the question that really arises is: how did two founders without billionaire backing crack a sector where billionaires failed?

Before diving into Indigo’s success story and how they cracked the market. Let’s understand

Why do airlines fail?

1) Aviation Turbine Fuel aka ATF:

Almost 40-50% of the cost is accounted for by ATF, and the most significant gap is in global oil supply. Oil, a highly volatile commodity, is often imported and can affect airlines due to changing geopolitical and economic conditions. The prices of oil keep fluctuating. Especially wars like Russia-Ukraine and Israel-Palestine spike the oil prices.

2) USD- INR volatility:

As Oil is traded in USD, and the INR is weakening against the USD, Companies end up paying more for the same quantity, even without doing anything, due to the changing exchange rates.

3) Demand Volatility:

If something like COVID-19 or political unrest in Bangladesh occurs, flights are immediately suspended. What really happens is that, although the flights are grounded, the fixed costs remain the same, including staff salaries, lease rentals, insurance, airport parking fees, and maintenance, among others.

4) Price Sensitivity:

As always, India is a highly price-sensitive market, and domestic airlines cannot command a premium by selling business class tickets, unlike Emirates, Qatar Airways, or Singapore Airlines. For instance, customers will opt for a 2 am flight to save ₹1000. Airlines cannot raise ticket prices above ₹5,000- ₹6,000 for domestic routes. Only cost efficiency decides survival.

5) Total Addressable Market of India (TAM):

Though we have a population of 1.4 billion, i.e., 3X the US, the TAM, or the Indian air passenger market, was just 161.5 million in 2017 (India 1 and 2), whereas in the US it is 632 million.

Now, the question that really arises is: how did two founders without billionaire backing crack a sector where billionaires failed?

Before commencing operations in 2006, Indigo placed an order for 100 Airbus A320S with an order value of $6 billion. The catch here was that these airlines were given a discount of almost 50%. And why this turned out to be a win-win strategy for Airbus, Indigo, and BOC Aviation (Singapore-based lessor):

1) Airbus Comeback into India:

All airlines in India have shifted to Boeing following the 1988 Indian Airlines Flight 113 and 1990 Indian Airlines Flight 605 crashes. To regain its reputation and make a strong comeback, Airbus needed a big Indian consumer. As a result, they offered discounts of up to 50% (according to sources).

2) BOC Aviation; Sale and Leaseback:

Instead of buying their own planes and showing them on their balance sheet, Indigo purchased the aircraft, then sold them and leased them back. This is beneficial for the leasing company because

· Getting the aircrafts cheaper than the market price

· Ready consumer available in the form of Indigo

3) Indigo’s cost efficiency strategy:

Since Indigo did a sale-and-leaseback, it made an upfront profit before the operation commenced. No maintenance costs (covered by Airbus/engine supplier), the aircraft was delivered every 45 days instead of all at once, because this would help them with cost control, crew familiarity, operational consistency, etc.

“It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.” — Warren Buffett.

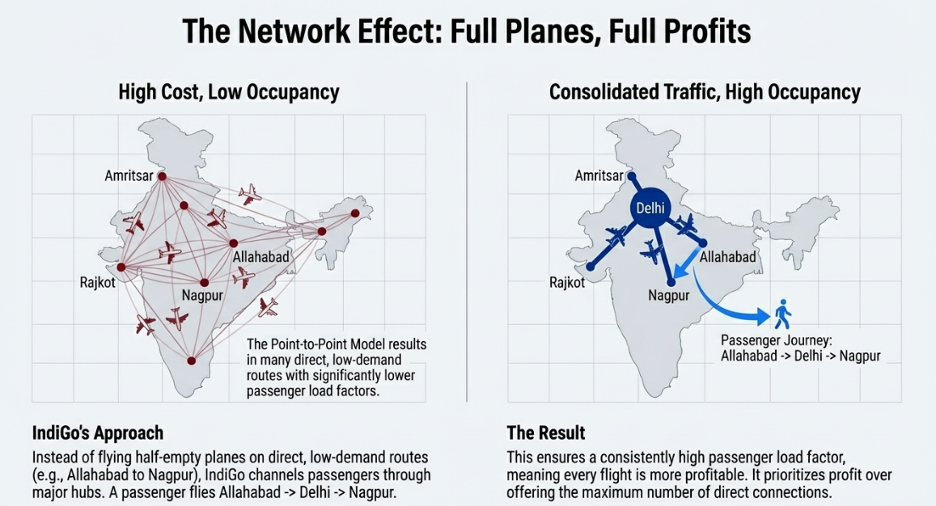

The strategies followed by Kingfisher and Jet Airways, compared to Indigo, were entirely different. Where the former provided free food, in-flight entertainment, and headsets, among other amenities, without charging much extra, resulting in heavier aircraft and increased fuel consumption, which, in turn, raised costs. For turnaround, it took them 45 – 60 minutes. They followed the point-to-point model (P2P), which required more plans, increased pressure to fill planes to maximum capacity, and consequently raised costs.

Indigo did the opposite; it offered just a seat with some leg space and on-time performance. There was no free food or entertainment, and it used ultra-light aircraft for simpler operations. Indigo followed the hub-and-spoke model (explained in the diagram above); they had a rapid turnaround time, averaging 20–25 minutes. They operated standardized fleets, i.e., A320S, which enabled them to maintain a uniform stock of parts with no extra costs associated with staff training. This resulted in massive cost savings. This results in the ability to offer low fares.

As said by someone, “Indians love living king-size, but don’t want to pay king-size.” Led to Indigo’s survival.

That’s what Indigo did, despite Indigo and Kingfisher almost starting together; one has been growing, while the latter has ceased to exist.

Where the International Air Transport Association (IATA) projects global airlines' profit margins of about 3-4% in 2025, and despite such thin margins, high fuel dependency, high capex, high regulation, highly volatile demand, why do the giants like Tata’s, Jhunjhunwala, remain bullish on the aviation sector, primarily because of:

India is the 3rd largest aviation market globally (PIB)

Domestic air passenger traffic for FY2025 is expected to grow ~ 7.6% YoY. International traffic for Indian carriers ~ 14.1% YoY. (ICRA)

But to achieve it:

India must build more airports

Increase per-capita income

Improve ease of doing business

Prevent unviable airport charges

Lessons that we can learn from the Indigo case study:

1) Understand your consumer needs:

As someone famously said, “Indians love living king-size, but don’t want to pay king-size.” Thus, as India is a price-sensitive market, it's crucial to match customer requirements to survive and foster growth. That’s what Indigo did, despite rising oil prices; it couldn’t just increase fares, given the fare cap for its customers, at times compromising its margins.

2) Learn from your competitors:

From Kingfisher: flamboyance is fatal and kills profits. From Jet Airways: the importance of strong leadership. Indigo understood it and designed its own moat speed and affordability.

3) Find opportunity in crisis:

Using Airbus' comeback to India to command discounts to poach Kingfisher staff, where salaries were long overdue, to get experienced and well-trained employees at lower costs. Indigo teaches how to convert problems into opportunities.

Just for instance, look for the profitability of the domestic carriers in 2015

Source: Think School, Tickertape

Source: Aravind A, LinkedIn

Authored By: Neil Fernandes

Disclaimer:

This article is intended solely for information and educational purposes and does not constitute any financial, investment or legal advice. The data and analysis presented are based on publicly available information, including the company’s Red Herring Prospectus (RHP) and reputable financial news sources. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher have no responsibility for any monetary losses or damages from reliance on the information contained herein.

Comments